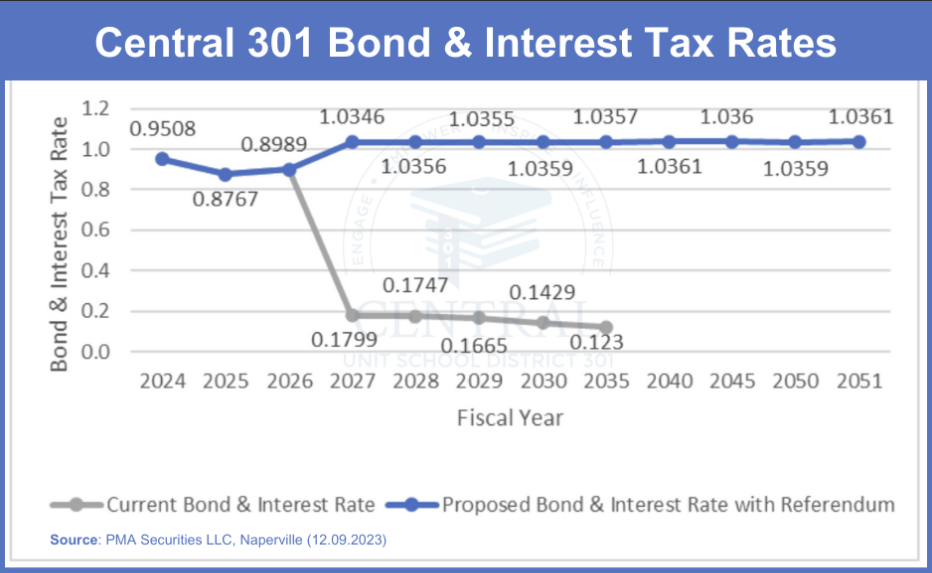

We know that any referendum will bring questions about tax implications to homeowners. In order to minimize the tax burden for our community members, we are structuring our bond debt so that payment on the new bonds will begin when current bonds are paid off. This will reduce the impact to taxpayers. The chart below shows the bond pay-off for the new construction of Country Trails Elementary School and Prairie Knolls Middle School in 2027. This decrease in bond debt is how the District is able to minimize the tax burden for our community.

Previous communications reflected an average home value of $335,000; however, this is limited to the village of Burlington. We recognize that many of our families have home values that are higher. A homeowner with a $400,000 home will see an increase of approximately $170 each year, beginning in 2027. That equates to roughly $14 a month, or about the same as the average ad-free monthly streaming service subscription.

You can see the impact this referendum will have on your property taxes by using the tax calculator tool* linked here. Please note that the calculator has several questions, see below:

The “Homestead Exemption” is generally yes if the homeowner is residing in the home. The other questions are dependent on your personal situation. For questions regarding exemption eligibility please go to https://assessments.kanecountyil.gov.

*It is important to note that Central 301 does not control other aspects of your property tax bill, such as your assessed home value and other taxing entities.