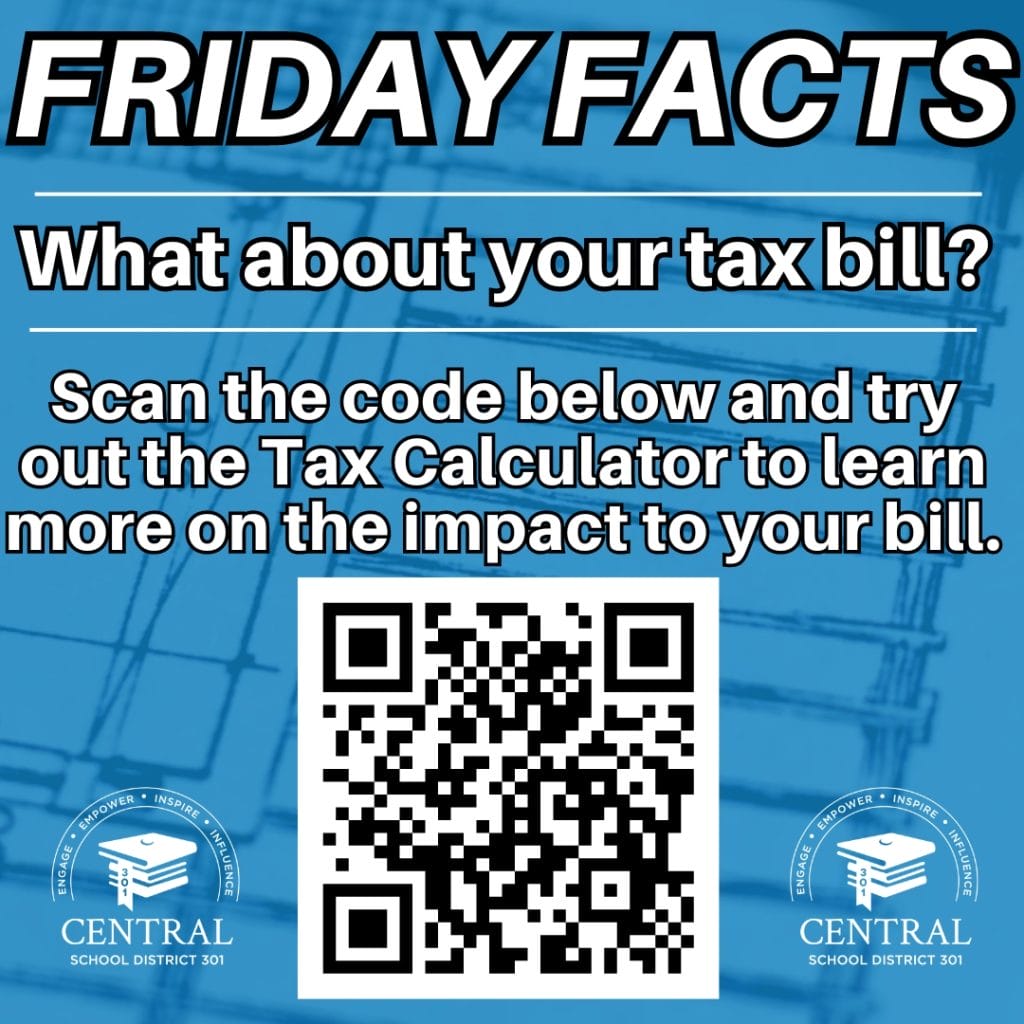

Friday Fact 9/6

If the referendum is approved, will my property taxes be impacted?

Yes. To minimize the impact, the District would structure the bond debt so payment on the new bonds would begin when current bonds are paid off. Additionally, new state legislation would allow the District to repay the bonds over a 30-year-period, rather than 20 years. If your home has a “fair cash value” (as determined by the tax assessor) of $407,000*, and you claim a homestead exemption, the increase would be approximately $116 per year. If you have additional exemptions available to you, the increase would be less. These calculations are based on financing the bond debt at current interest rates; if interest rates decrease in the future, the District would consider refinancing options to reduce the cost further.

(*Per RSP Associates, the Median Home Value in the District is $406,928).

Here is a tax calculator tool to allow you to estimate the impact of an approved referendum on your property taxes.